The end of the year can be a time for planning and reflection.

The end of the year can be a time for planning and reflection.

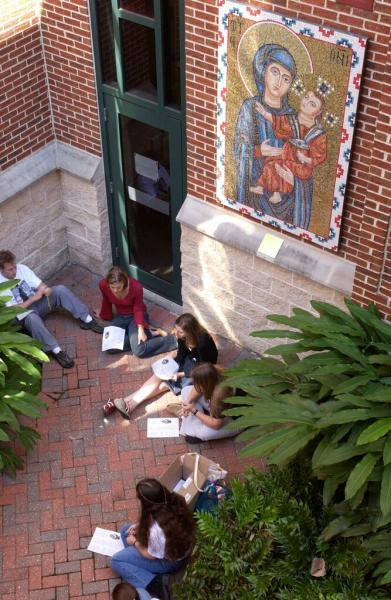

As December 31st approaches and 2018 comes to a close, you may be wondering if you have done all that you can to support Loyola University New Orleans and our Jesuit mission. When you itemize your tax deductions, the gifts that you make to nonprofit organizations, such as Loyola University New Orleans, can benefit you as well as your favorite causes.

If you have not made your charitable contribution for 2018, now is the time to ensure your gifts count on this year's tax return.

Credit Card

Must be received by 11:59 p.m. on December 31, 2018.

Loyola University New Orleans

Office of Institutional Advancement

7214 St. Charles Ave.

Campus Box 909

New Orleans, LA 70118

Must be postmarked by December 31.

Phone

Laurie Leiva, Assistant Vice President for Alumni Engagement 504-920-8485

Stephanie Hotard, Executive Director of Development 504-495-4423

Chris Wiseman, Vice President for Institutional Advancement 504-583-3965

Stocks, Bonds, or Mutual Funds

Provide the following transfer instructions to your broker:

- Morgan Stanley, 1100 Poydras St., Suite 1900, New Orleans, LA 70163, Attn: Helen Smith Guidry, CFP

- Phone: (504) 585-3996

- Fax: (504) 910-7660

- Loyola University New Orleans Account No: 575-017708

- DTC# 0015

- Email: helen.smith.guidry@morganstanley.com

To help us track your transfer, contact Monique Gardner, Director of Gift and Estate Planning, at mgardner@loyno.edu or 504-430-4951 with the following information:

- Stock you intend to transfer

- Approximate value of your gift

- Your broker's name and phone number